RISE Insurance is located in downtown Chattanooga, TN but we help insure people and companies all over the country. We specialize in top notch service and extensive market access to place your business with the best possible carrier at the best possible price.

Landlord & Income Properties

Income property investing is still increasing

In 2024, 13% or 610,000 properties nationwide were purchased as income properties.

Many business-minded individuals are either already involved in, or are getting involved in, income properties. These individuals also understand how important insurance can be—whether you’re simply the property owner or have decided to jump into the remodeling side of the business

What does Landlord coverage include?

Coverage A: The main dwelling

Coverage B: Other structures on the property such as driveways, fences, detached garages.

Coverage C: Personal property or household furnishings. This coverage can be customized if you, the property owner, have items on the property; however, it is typically $0, as a landlord policy does not cover the tenant’s belongings.

Coverage D: Loss of Use. This covers the loss of rental income you would have earned if a tenant had to move out due to repairs for a covered loss. For example, if a pipe burst and the tenant had to move out for two months, you may not be receiving rent but would still have bills due, such as utilities or even a mortgage. This coverage helps offset those costs.

Coverage E: The Premises liability coverage used if the property owner is at fault of an injury to the renter. One example that comes to mind is a set of basement stairs without a handrail. If the renter slips and falls, you could be held liable for their injuries.

Coverage F: Medical Payments. This is a first line of defense for an accident such as falling down the stairs. terms mean?

What are the different levels of coverage?

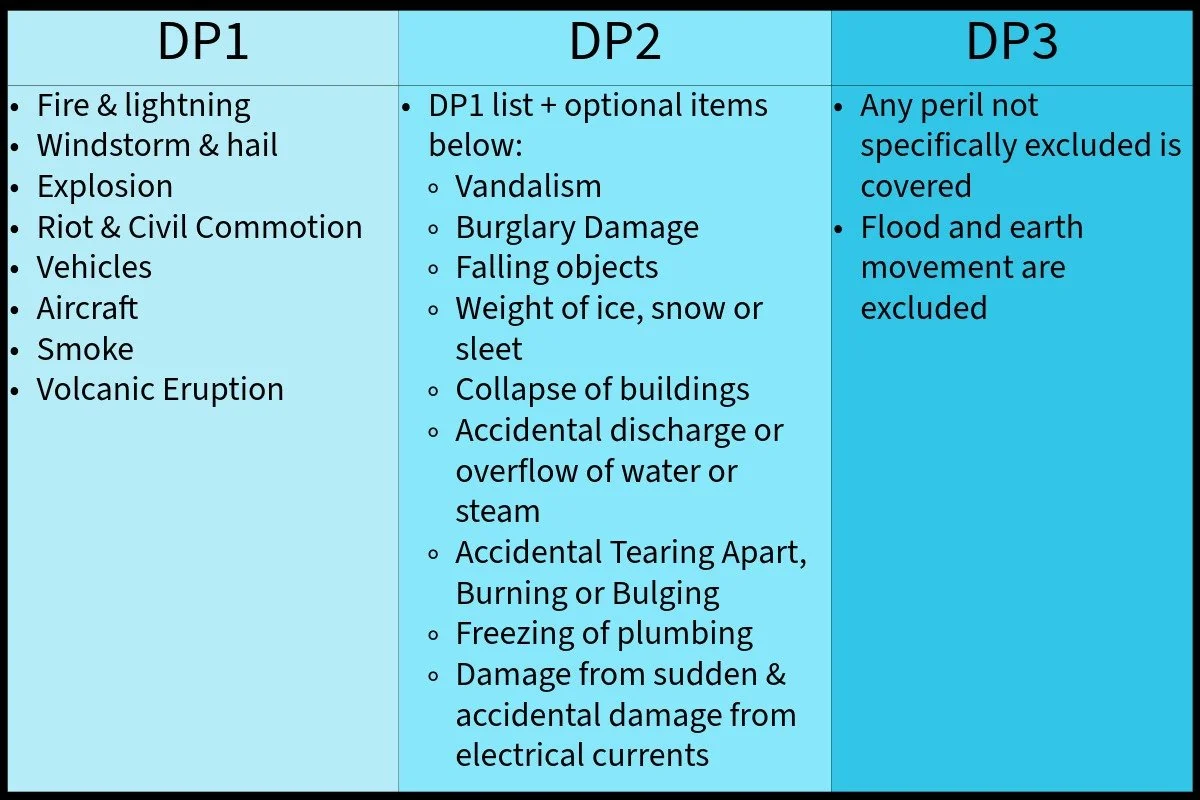

Dwelling 1, 2 or 3 are the different peril coverage levels. Here is a chart that shows a good summary of covered perils:

*Every carrier reserves the right to customized their policies. It is important that you read over your policy to know what you are and are not covered for.

Fix and flip opportunities

What if managing renters isn’t one of your many talents, but fixing up houses is? We can help with that by adding a builder’s risk endorsement to a vacant dwelling policy. Here are some of the things you’ll want to pay attention to and share with us when it’s time to get your insurance:

What age is the home"?

Is there knob-and-tube wiring or lead pipes?

Year of any updates (roof, electrical, plumbing, and HVAC).

Current square footage.

Type of dwelling: condo, single-family, duplex, fourplex, or larger.

Scope of work you plan to complete, including budget.

Are you increasing the square footage and need a full builder’s risk policy, or

Are you doing a facelift that could be written as a vacant property with a builder’s risk endorsement?

Time frame – we offer 3-month, 6-month, 9-month, annual, pay-in-full, and monthly options.

Are you completing the work yourself or using a contractor?

Should I put the properties in an LLC or in my name?

This is a great question and one that should also be discussed with your accountant. Every financial and risk situation is different, and unfortunately, it’s not something we can answer broadly.

The good news is that we can write the policies however they are owned — even if they’re placed in a trust.

If you are ready to get the process started, please follow one of these links below to our online questionnaires.